After the separation of parents, raising a Child is a very complicated task. Specifically in the case where 50/50 custody is there. In the cases of Joint Custody, the 50/50 Child Support Calculator takes place. In the 50/50 Child Support Calculator, we assume the equal liability of both the parents. Even in the case of the 50/50 Child Support Calculator, the appropriate amount is quite difficult.

What does it actually mean 50/50 Child Support Calculator?

The amount on which both parents agreed with the approval of the Court of Law to contribute financially for their child’s upbringing on equal payment of upbringing expenses irrespective of the income they earn. Their current assets are also considered while using the 50/50 Child Support Calculator.

It’s the first priority of every separating parent to share an equal burden of financial expenses. Where the number of children is more than 2 the calculation of the Child Support amount is tougher. Usually, the parent spending less time with the child is responsible for making payments. Further, we shall discuss how to use the 50/50 Child Support Calculator in case of divorce.

How does Child Support work?

In the case of Joint Custody, the expenses are equally divided. The Calculation of Child Support Payment becomes straighter forward. In a few cases, both the parents have the same source of income where education expense, health insurance, conveyance, etc. is paid from a single resource only.

In the 50/50 Child Support Calculator, Parents think since they have equal custody then, there is no need for payment to each other and they shall bear expenses on their own. But this is not the criteria we follow in joint custody.

How to Calculate the Child Support obligation?

For this example,

We will consider one child involved where one parent earns more than the other. Parent 1 has earnings of $1000, 000, while parent 2 earns $500,000. These are yearly incomes for both parents. From the Federal Child Support Table, we can identify that parent one would have had a child support amount of $1, 4160, and parent two would have had an amount of $7430. The difference between these amounts is $6730. As parent 1 has a higher income than parent 2, $6730 is the child support amount to be paid by parent 1 to parent 2.

What is a Child Support Calculator?

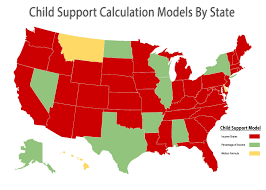

In general terminology, the Child Support Calculator is an estimation of the Maintenance amount paid by the non-custodial parent to the custodial parent. This is finally arrived at and justified by the court of law depending upon the income sources of the parents. Based on the state you live the method of Calculation will vary.

The first question arises when we Google about 50/50 Child Support Calculator it’s the name of the state where the case is filed or the family lives. There may be situations when both parents live in different states of America.

In those circumstances, the court of law where the case is filed will matter a lot for the calculation of the Child Support amount. The Child Support Calculator of that specific state will be used. Another factor that determines the payment is the number of children of separated parents.

Child Support worksheets are used by the court for the Calculation of Child Support Payment. These worksheets actually excel documents for prompt estimation of maintenance amount.

Termination of Child Support Obligation

The Primary Residential Parent will receive the committed amount till the child complete his/her High school or at their graduation whatever comes later and it may stretch up to the age of 21 when the child has some disability.

If any arrear in past is due after the Termination of payment of child support the Non- custodial parent is still under obligation to clear the dues even after the termination of the obligation period as per the court of law.

End Notes: The income shares model of Tennessee child support is based upon the criteria that in case of the sensitive matter of Separation or divorce the child should not bear the adverse consequences and must get the justified amount for their better livelihood.

Therefore, the model is based upon the factor to determine the Net income of each parent considering the justified amount accordingly spent with children by each parent, so children need not sacrifice for their well-being. The agenda is to give a better life to the children of separated parents.