The families making decisions for divorce or separation having children need to follow the court’s order for Child Support. It’s a basic human right of every child a well-managed life fulfilled with all basic needs of food, education, shelter, and other essential amenities. In this write-up, we shall discuss the PA Child Support Calculator, and how a non-custodial parent can figure out the average child support payment by using PA Child Support Calculator.

According to Pennsylvania Rules of Civil Procedure, the support guidelines are not just made for PA Child Support Calculator, though it’s more than money. The Idea behind Child support is to raise a child with emotional well-being too along with covering the cost to raise a child. The people after divorce are no more together in a relationship but they are always bound to perform their responsibilities for their children.

What is PA Child Support Calculator?

In Pennsylvania, the Court of law uses Child Support Calculator PA to determine the average amount receivable by the custodial parent of children from the non-custodial parent. The PA Child support guideline says that the parent who spent more time with the child will receive the child’s support. On the other hand, a parent who spent less time with the child is under obligation to pay the child support as worked out from PA Child Support Calculator.

The PA child support is calculated using the Income sharing method where one parent is liable to pay the child support to another parent as per support guidelines.

The cases where both parents spent equal time, in such cases, Parent who earns lower income are eligible to receive child support custody. The parent with the higher income is under obligation to pay the child support amount to the other parent as per PA Child support guidelines. This is generally called 50-50 custody where both parents are spending equal time with their child in Pennsylvania.

How do they calculate Child Support in PA?

The PA Child Support Calculator follows the model of 50-50 custody or shared custody of the child when parents live separately and the Parent who spends more than 50% of overnights in the span of 2 weeks shall be eligible to receive the child support as per the Child Support Guidelines in Pennsylvania, though it’s already assumed while calculating the average child support obligation that custodial parent already contributes financially for the well-being of the child as the child stays more with the custodial parent.

The general question that remains in the mind of separating parents always, Is PA child support is based upon gross or net income? As parents making money need to separate their retirement savings and payments of state taxes and dues therefore Child support is calculated on the net income of each parent.

To calculate the child support obligation in Pennsylvania, the first step is to find the Adjusted Gross Income/Net of each parent on a monthly basis which includes the following:

| (1) Wages and salaries, bonus or commissions; |

| (2) Income from Capital Gains; |

| (3) Rental Income, interest, or dividends received; |

| (4) Pensions; |

| (5) Income from an estate or trust; |

| (6) Disability benefits either permanent or temporary, Unemployment benefits if any. |

| (7) Alimony funds if eligible as per support guideline; |

| (8) Income from other sources like (i) lottery winnings; (ii) Tax refunds and interests; (iii) insurance compensation or settlements; (iv) awards and verdicts; and |

2. Once we add all the items mentioned in Point no.1, the following items will be subtracted.

| i) Health Insurance of Child |

| ii) If any income of Child |

| iii) Public Assistance Benefits/SSI Benefits |

| iv) Other Child Support Payment from Previous marriage |

| v) Mandatory retirement payments |

| vi) Any other union dues. |

3. Combined net income of both parents after the adjustments as detailed above. The proportionate share will be calculated for the payment of average child support considering the number of children parents have.

If it seems confusing, then the following example will be helpful-

Parent 1 and Parent, combined income after adjustment is $6000 where Parent 1 earns $2500 and Parent 2 earns $3500 here Parent 2 spends more time with the child and has custody of the child.

Parent 2 divides his net income with the total income after adjustments i.e. $6000/$3500 and the result is 0.583 where the percentage share of parent 2 is 58% of the total net income of both the parents considering the PA child support guidelines.

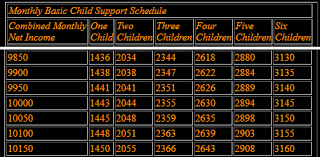

Now as per the PA child support worksheet after finding the net combined income, if we refer to the child support worksheet the amount shall be $1071 for a single child and $1523 for 2 children, and the rest can be considered from the PA child support worksheet.

How adjustments are made in Basic child support for additional expenses in Pennsylvania?

Basic child support payment is based upon certain additional expenses we spent on the upbringing of the child. Such shared payments include:

| 1 | Health Insurance premium of children. |

| 2 | Daycare expenses or child care fees, if any. |

| 3 | Private coaching fees. |

| 4 | Extra-curricular activity or sports fee. |

| 5 | Clothing or traveling expenses. |

The above table is not the complete list of any additional expenses as they are endless based upon the lifestyle we provide to our children. These expenses are proportionately distributed between both parents as per the percentage of their combined net income as per the PA Child support calculator.

The obligation for payment of child support will be increased in addition to the obligatory payment of child support in Pennsylvania.

Now we shall understand the same with a hypothetical situation where Parent 1 is under obligation to pay the child support of 58% of the total net income of both the parents and Parent 2 is paying $400 monthly for day-care.

The daycare expenses are necessary for Parent 2 to work and earn, hence the child support amount will be increased by an amount of $232 as a 58% share in the additional expense.

What is the average child support payment for one child in PA?

The Pensylvania Child Support Calculator results in the amount of child support considering the number of children. The parents with one child are under obligation to pay the child support amount as per the percentage of their combined net income and then refer to the worksheet.

The PA child support worksheets provide the upper limit on the net combined income of $30,000 and a lower limit of $1000. The average child support paid for one child by parents earning $30,000 is $2839 and for the parents earning $1000 monthly is $17 for one child.

The Pennsylvania child support worksheets give average child support up to six children, which is payable to the parent who spent more than 50% overnights with the children. Though it’s a tough job to find the estimated child support amount in 50/50 custody cases which is not straightforward.

Factors to be considered while finalizing the child support amount.

While calculating the child support amount the parent who spends more than 40% overnights will receive a discount on the payment of child support as mentioned in Pennsylvania child support guidelines.

The amount of child support as per the Pennsylvania child support calculator is only an estimation of child support. The final amount is always decided as per the court’s order taking into account any special circumstances.

The payment of child support is an ongoing amount payable up to the age of 18 of the child or till graduation as per the court’s order but the same can be increased or decreased in the future. The request for a change in child support amount can be made upon subsequent changes in the income of the parents.

Bottom Lines for Pennsylvania Child Support Calculator:

The PA child support calculator works only where both parents are earning the same set of incomes monthly or yearly. In the cases where one or both parents are earning fluctuating amounts or irregular income then there is no use of PA Child support guidelines. In such cases, only negotiations in the court will work to finalize the child support.

A child support calculator is a tool used to estimate the amount of financial support that a parent may have to pay for their child or children. In Pennsylvania, the amount of child support is determined by a set of guidelines established by state law.

The calculator in Pennsylvania takes into account a number of factors, such as the income of both parents, the number of children, and any expenses related to the care of the children, such as health insurance or daycare costs.

To use the calculator, you’ll need to provide information about your income, the other parent’s income, and any expenses related to the children’s care. The calculator will then provide an estimate of the amount of child support that may be owed.

Keep in mind that the child support calculator is only an estimate and the actual amount of child support may vary depending on the specific circumstances of your case. It’s important to consult with a family law attorney if you have any questions or concerns about child support.