Compliance management of the listed entities is one of the most crucial tasks performed by a Compliance officer or we can say a company secretary, though in the era of remote working and virtual meetings it requires much discipline to complete the quarterly compliances performed by a listed company.

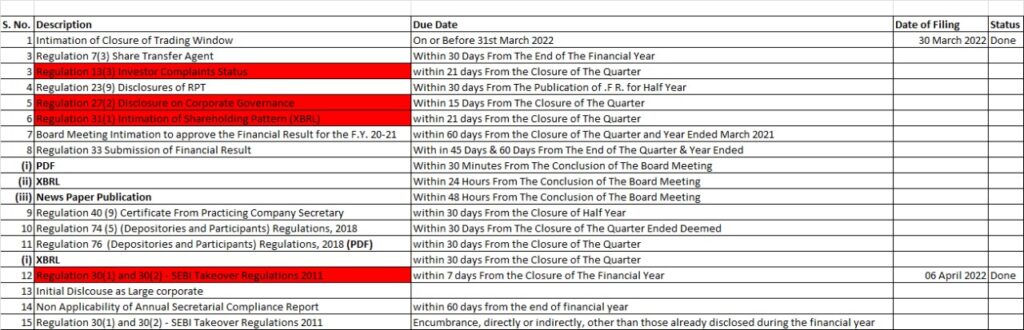

Here in this post, we are going to understand the Compliance checklist of a listed company:

In this write-up, I begin with Annual compliances applicable to Listed companies.

Annual Compliances of Listed Company.

- Regulation 7 (3) – Share Transfer Agent Within 30 days from the end of the financial year

- Regulation 23 (9) – Disclosures of related party transactions within 30 days from the date of publication of its standalone and consolidated financial results

- Regulation 24A – Secretarial Compliance Report within 60 days of the end of the financial year

- Regulation 33 (3) (d) – Financial Results along with Auditor’s Report within 60 days from the end of the financial year

- Regulation 34(1) – Annual Report Not later than the day of commencement of dispatch to its shareholders.

- Regulation 40 (10) – Transfer or transmission or transposition of securities within 30 days from the end of the financial year

- Initial Disclosure requirements for large entities Within 30 days from the beginning of the FY

- Annual Disclosure requirements for large entities within 45 days of the end of the FY.

Annual Secretarial Compliance Report for Listed Company:

“24A: Secretarial Audit Every listed entity and its material unlisted subsidiaries incorporated in India shall undertake a secretarial audit and shall annex with its annual report, a secretarial audit report, given by a company secretary in practice, in such form as may be prescribed with effect from the year ended March 31, 2019.”

Accordingly, the following shall be complied with by a listed entity and its material unlisted subsidiaries, as applicable: a. Annual secretarial audit report:

- Section 204 of the Companies Act, 2013 read with rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 requires Secretarial Audit by Practicing Company Secretaries (PCS) for listed companies and certain unlisted companies above a certain threshold in From No. MR-3.

- In order to avoid duplication, the listed entity and its unlisted material subsidiaries shall use the same Form No. MR-3 as required under the Companies Act, 2013 and the rules made thereunder for the purpose of compliance with Regulation 24A of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 as well.

Listed Company Regulation 40 (10) – TRANSFER OR TRANSMISSION OR TRANSPOSITION OF SECURITIES:

- The listed entity shall also comply with the requirements as specified in this regulation for effecting the transfer of securities. Provided that, except in case of transmission or transposition of securities, requests for effecting transfer of securities shall not be processed unless the securities are held in the dematerialized form with a depository.

- The board of directors of a listed entity may delegate the power of transfer of securities to a committee or to the compliance officer or to the registrar to an issue and/or share transfer agent(s):

Provided that the board of directors and/or the delegated authority shall attend to the formalities pertaining to the transfer of securities at least once in a fortnight:

Provided further that the delegated authority shall report on the transfer of securities to the board of directors in each meeting.

- On receipt of proper documentation, the listed entity shall register transfers of its securities in the name of the transferee(s) and issue certificates or receipts or advices, as applicable, of transfers; or issue any valid objection or intimation to the transferee or transferor, as the case may be, within a period of fifteen days from the date of such receipt of the request for transfer: Provided that the listed entity shall ensure that transmission requests are processed for securities held in dematerialized mode and physical mode within seven days and twenty-one days respectively, after receipt of the specified documents: Provided further that proper verifiable dated records of all correspondence with the investor shall be maintained by the listed entity.

- The listed entity shall ensure that the share transfer agent and/or the in-house share transfer facility, as the case may be, produces a certificate from a practicing company secretary within thirty days from the end of the financial year, certifying that all certificates have been issued within thirty days of the date of lodgement for transfer, sub-division, consolidation, renewal, exchange or endorsement of calls/allotment monies.

- The listed entity shall ensure that the certificate mentioned at sub-regulation (9), shall be filed with the stock exchange(s) simultaneously.

Listed Company Regulation 7 (3) – SHARE TRANSFER AGENT

- The listed entity shall appoint a share transfer agent or manage the share transfer facility in-house: Provided that, in the case of in-house share transfer facility, as and when the total number of holders of securities of the listed entity exceeds one lakh, the listed entity shall either register with the Board as a Category II share transfer agent or appoint Registrar to an issue and share transfer agent registered with the Board.

- The listed entity shall ensure that all activities in relation to the electronic share transfer facility are maintained either in-house or by Registrar to an issue and share transfer agent registered with the Board.

- The listed entity shall submit a compliance certificate to the exchange, duly signed by both the compliance officer of the listed entity and the authorized representative of the share transfer agent, wherever applicable, within one month of the end of each half of the financial year, certifying compliance with the requirements of sub-regulation (2).

You are free to ask any query regarding the filing of Compliances by a Listed entity or you may mail us @ [email protected] as I read all my e-mails.

References

- https://www.bseindia.com/corporates/compliancecalendar.aspx

- https://www.nseindia.com/companies-listing/compliance-information-compliance-calendar-sme