Introduction Child Support Calculator Florida

The Child Support Calculator Florida is a powerful tool designed to assist parents in determining the appropriate child support amounts. It takes into account various factors, including both parents’ incomes, time-sharing arrangements, and specific expenses related to the child’s needs, such as healthcare and education.

Table of Contents

Child support is a critical aspect of family law, ensuring that children receive the financial support they need to thrive even when their parents are separated or divorced. In Florida, like many other states, child support calculations follow specific guidelines designed to be fair and consistent. To make the process more accessible and transparent, Florida offers a Child Support Calculator. In this comprehensive guide, we’ll walk you through how to use the Florida Child Support Calculator effectively, providing valuable insights into the process and helping you understand your rights and responsibilities.

Step-by-Step Guide Child Support Calculator Florida

- Gather Financial Information: Start by collecting detailed financial information from both parents. This includes their monthly incomes, deductions, and any additional expenses related to the child.

- Determine Combined Monthly Income: Add together the gross incomes of both parents to determine the combined monthly income.

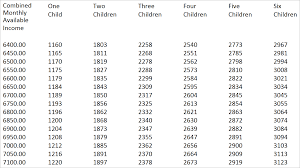

- Calculate the Basic Child Support Obligation: The Florida Child Support Guidelines provide a schedule for calculating the basic child support obligation based on combined income and the number of children involved.

- Distribute Costs for Additional Expenses: Consider expenses such as health insurance, daycare, and extraordinary medical or educational costs. The court will determine how these expenses are shared based on each parent’s income.

- Calculate Each Parent’s Percentage Share: Determine each parent’s share of the basic child support obligation and additional expenses based on their percentage of the combined income.

- Determine Parental Responsibility: The court assigns a percentage of parental responsibility, which takes into account the time-sharing arrangement (number of overnights with each parent).

- Adjust for Time-Sharing: If one parent has more than 20% of the overnights, it may result in an adjustment to the child support amount.

- Calculate the Final Child Support Obligation: Combine the basic child support obligation, additional expenses, and adjustments for parental responsibility and time-sharing.

- Document and Submit: Ensure that all calculations and information are properly documented and submitted to the court for approval.

- Review and Modify: Child support orders can be reviewed and modified if there are substantial changes in circumstances, such as income changes or significant alterations in the child’s needs.

Benefits of Using the Florida Child Support Calculator

The Florida Child Support Calculator offers several advantages, including transparency, consistency, and efficiency. It helps both parents understand the basis for child support calculations and ensures that children receive the financial support they require. Additionally, it promotes fairness by considering various factors such as income, time-sharing, and expenses, ultimately leading to more equitable outcomes.

How do I check my child support in Florida?

Checking your child support status in Florida involves a few straightforward steps. Here’s a simple guide to help you navigate the process:

- Access the Florida Department of Revenue Website:Visit the official website of the Florida Department of Revenue (DOR). The DOR oversees child support services in Florida.

- Locate the Child Support Section:Once on the website, look for the section related to child support. This may be prominently displayed on the homepage or located within a “Services” or “Family” section.

- Log In or Create an Account:To access your specific child support information, you will likely need to log in to your account. If you don’t have an account, there should be an option to create one. You may need to provide personal information to verify your identity.

- Navigate to the Child Support Case:After logging in, you should be able to find information related to your child support case. This may be listed under your profile or in a dedicated section for child support cases.

- View Case Details:Once you’ve located your child support case, you should be able to view details such as payment history, upcoming payments, and any communications related to the case.

- Contact the Florida Department of Revenue (Optional):If you encounter any difficulties accessing your child support information online, you can contact the Florida Department of Revenue’s Child Support Customer Service line for assistance. They can guide you through the process or provide you with any necessary information.

- Regularly Check for Updates:It’s a good practice to periodically log in to your account to check for updates or changes in your child support case. This helps you stay informed about the status of payments and any other relevant information.

Remember to protect your login credentials and personal information to ensure the security of your child support account. If you encounter any issues or have questions about your child support case, don’t hesitate to reach out to the Florida Department of Revenue for assistance. They are there to help you navigate the child support process.

A Guide to Using the Florida Child Support Login

Managing child support responsibilities in Florida has never been more convenient, thanks to the online services provided by the Florida Department of Revenue. The Florida Child Support Login portal offers a user-friendly platform for parents to access and monitor their child support cases. In this comprehensive guide, we’ll walk you through the steps to utilize the Florida Child Support Login effectively, ensuring you can easily stay informed about your child support obligations.

The Florida Child Support Login is a secure online platform provided by the Florida Department of Revenue. It allows parents to access their child support case information, including payment history, upcoming payments, and any recent communications related to the case. This convenient tool streamlines the process of managing child support responsibilities, providing a user-friendly interface for parents to stay informed about their obligations.

Creating Your Florida Child Support Login Account

If you’re new to the Florida Child Support Login, the first step is to create your account. Visit the official website of the Florida Department of Revenue and look for the registration or sign-up option. You’ll need to provide personal information to verify your identity. Once your account is set up, you can log in anytime using your unique credentials.

Logging In to Your Florida Child Support Account

For returning users, accessing your Florida Child Support account is a breeze. Simply visit the official website, locate the login section, and enter your username and password. This will grant you secure access to your child support case details, allowing you to review payment history, upcoming payments, and any pertinent communications.

Navigating Your Child Support Dashboard

Once logged in, you’ll find a user-friendly dashboard that provides an overview of your child support case. You can easily view details such as payment history, upcoming payments, and any recent communications from the Florida Department of Revenue. The dashboard is designed for intuitive navigation, ensuring you can quickly find the information you need to stay on top of your child support responsibilities.

Tips for Efficient Child Support Management

- Regularly Check Your Account: Make it a habit to log in to your Florida Child Support account to review the latest updates and ensure all information is accurate.

- Set Up Notifications: Take advantage of any notification features available through the portal. This can help you stay informed about important changes or upcoming payments.

- Keep Your Information Updated: If there are any changes in your personal or financial circumstances, be sure to update your account promptly to ensure accurate child support calculations.

Conclusion

The Florida Child Support Login portal is a valuable resource for parents managing child support responsibilities. By following the steps outlined in this guide, you can confidently utilize this online platform to stay informed and in control of your child support obligations. Streamline your child support management with ease and convenience, all at your fingertips. Access your Florida Child Support Login today!

Understanding Child Support Payments in Florida

Child support payments in Florida are financial contributions made by the non-custodial parent to assist with the child’s living expenses, such as food, clothing, housing, and education. The payments are calculated based on a variety of factors, including the income of both parents, the number of children, and any special circumstances.

Methods of Making Child Support Payments

- Income Withholding Orders (IWOs): This is the most common method where child support is automatically deducted from the paying parent’s paycheck and sent directly to the Florida State Disbursement Unit (SDU).

- Electronic Funds Transfer (EFT): This allows parents to make payments electronically through the SDU’s website, ensuring timely and secure transactions.

- Payment by Mail: Parents can also choose to make payments by check or money order. However, it’s important to include the necessary information to ensure proper processing.

Receiving Child Support Payments in Florida

If you are the custodial parent receiving child support, the payments will be sent to you through the Florida State Disbursement Unit (SDU). It’s crucial to keep your contact information updated to ensure there are no disruptions in receiving the payments.

Child Support Payment Schedule

Child support payments in Florida are typically due on the first of each month. However, it’s important to note that the actual date of disbursement may vary based on factors like weekends and holidays.

Ensuring Timely and Consistent Payments

- Open Communication: Maintain open lines of communication with the other parent to address any concerns or issues regarding child support payments.

- Keep Records: Both parents should keep detailed records of all child support payments made or received, including dates, amounts, and any relevant correspondence.

- Seek Legal Advice if Necessary: If there are disputes or challenges regarding child support payments, consulting with a family law attorney can provide valuable guidance.

Conclusion

Navigating child support payments in Florida is crucial for the well-being of children. By understanding the process and utilizing the available methods, both parents can contribute to the financial support of their child. Remember to communicate openly and seek legal advice if needed to ensure a smooth and consistent child support experience.

Does Florida enforce child support from other states?

Yes, Florida enforces child support orders from other states through a legal process known as “interstate child support enforcement.” This process is governed by the Uniform Interstate Family Support Act (UIFSA), which has been adopted by all U.S. states, including Florida.

Under UIFSA, child support orders issued in one state can be enforced in another state, ensuring that parents who owe child support cannot evade their financial responsibilities by relocating to a different state. This allows for consistent enforcement of child support obligations across state lines.

Here’s how the process generally works:

- Registration of Foreign Child Support Orders: To enforce a child support order from another state, the custodial parent (or the state agency responsible for child support enforcement) must register the order with the appropriate authorities in Florida.

- Confirmation of Order: Once registered, the Florida courts review the out-of-state order and confirm its validity. This involves ensuring that the order meets legal requirements and is in compliance with Florida’s child support laws.

- Enforcement Actions: Once the order is confirmed, Florida can take various enforcement actions to collect child support payments. These actions may include income withholding, intercepting tax refunds, suspending driver’s licenses, and placing liens on property.

- Communication with Other State: Florida may work closely with the child support agency in the other state to coordinate enforcement efforts and share information about the case.

It’s important to note that while UIFSA provides a framework for interstate child support enforcement, each case may have unique complexities. Consulting with a family law attorney or contacting the Florida Department of Revenue’s Child Support Program can provide specific guidance and assistance in enforcing child support orders from other states.

How do you enforce child support in Florida?

Enforcing child support in Florida involves a structured legal process to ensure that non-custodial parents fulfill their financial responsibilities towards their children. Here’s a step-by-step guide on how child support enforcement typically works in Florida:

**1. Opening a Child Support Case:

- The first step is to open a child support case. This can be done through the Florida Department of Revenue’s Child Support Program, either by filling out an application online, in person at a local office, or by calling the customer service hotline.

**2. Locating the Non-Custodial Parent:

- The Child Support Program will work to locate the non-custodial parent if their whereabouts are unknown. This may involve using various resources, including databases and public records.

**3. Establishing Paternity (if necessary):

- If paternity has not been legally established, it will be necessary to do so. This can be accomplished voluntarily by both parents or through legal action.

**4. Determining Child Support Obligation:

- The Child Support Program will calculate the non-custodial parent’s child support obligation based on Florida’s child support guidelines, taking into account both parents’ incomes, the number of children, and any additional expenses.

**5. Notifying the Non-Custodial Parent:

- The non-custodial parent will be notified of the child support order, detailing the amount and frequency of payments.

**6. Income Withholding:

- In many cases, child support payments are automatically deducted from the non-custodial parent’s paycheck through an Income Withholding Order (IWO).

**7. Enforcing the Child Support Order:

- The Child Support Program has various enforcement tools at its disposal, including:

- Income Withholding: This involves deducting child support payments directly from the non-custodial parent’s paycheck.

- Intercepting Tax Refunds: The program can intercept federal and state tax refunds to collect past-due child support.

- Driver’s License Suspension: The non-custodial parent’s driver’s license can be suspended for non-payment of child support.

- Placing Liens: Liens can be placed on property or other assets owned by the non-custodial parent.

- Credit Reporting: Delinquent child support payments can be reported to credit bureaus, potentially impacting the non-custodial parent’s credit score.

**8. Monitoring and Adjusting Child Support:

- The Child Support Program regularly reviews child support orders to ensure they remain fair and appropriate. If there are significant changes in circumstances, such as a substantial change in income, they may seek a modification.

It’s important to note that while these are the general steps, specific cases may have unique complexities. Consulting with the Florida Department of Revenue’s Child Support Program or seeking legal advice can provide specific guidance and assistance in enforcing child support in Florida.

Can Mother Cancel Child Support?

In most legal systems, including in the United States, the decision to cancel child support lies primarily with the court, not solely with the custodial parent (whether it’s the mother or father). This is because child support is considered the right of the child, not the custodial parent, and it’s intended to ensure the child’s well-being and financial support.

Here are some common scenarios where child support may be modified or terminated:

- Voluntary Agreement: If both parents agree to modify or cancel child support, they can submit a formal request to the court. The court will review the request to ensure it’s in the best interests of the child.

- Change in Circumstances: If there has been a significant change in circumstances, such as a substantial change in the income of either parent, a change in custody arrangements, or other relevant factors, the court may consider modifying or terminating child support.

- Emancipation of the Child: Child support typically ends when the child reaches the age of majority, which is 18 in many states. However, it may be extended if the child has special needs or is still in high school.

- Child’s Adoption: If the child is legally adopted by another person, the biological parent’s child support obligation may be terminated.

- Parental Rights Terminated: In cases where a parent’s rights are terminated through legal proceedings, their child support obligation may also be terminated.

It’s crucial to note that any changes to child support must be approved by the court. Informal agreements between parents without court approval may not be legally binding and can lead to complications in the future.

If a parent, whether it’s the mother or father, wishes to seek a modification or termination of child support, it’s advisable to consult with a family law attorney who can provide guidance on the proper legal procedures and represent their interests in court.