In the world of business and finance, understanding the difference between gross profit and net profit is essential for sound financial management and decision-making. These two terms are often used interchangeably, but they represent distinct aspects of a company’s financial performance. In this article, we will delve into the nuances of gross profit and net profit, highlighting their definitions, calculations, and significance in business operations.

Table of Contents

Gross Profit vs Net Profit

Gross profit and net profit are key indicators of a company’s financial health, but they serve different purposes and provide distinct insights into its operations. Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS) from total revenue. It reflects the profitability of a company’s core business activities and is a measure of its production efficiency and pricing strategy.

On the other hand, net profit, also known as the bottom line, is the remaining profit after deducting all expenses, including operating expenses, taxes, interest, and other non-operating costs, from gross profit. Net profit reflects the overall profitability of a company after accounting for all expenses and taxes.

Comparison Table Between Gross Profit and Net Profit

When analyzing the financial performance of a company, understanding the difference between gross profit and net profit is crucial. These two metrics provide distinct insights into various aspects of a company’s operations, profitability, and financial health. Let’s delve deeper into the comparison between gross profit and net profit through the following table:

| Aspect | Gross Profit | Net Profit |

|---|---|---|

| Definition | Gross profit represents the difference between total revenue and the cost of goods sold (COGS). It reflects the profitability of a company’s core business activities. | Net profit, also known as the bottom line, is the remaining profit after deducting all expenses, including operating expenses, taxes, interest, and other non-operating costs, from gross profit. It indicates the overall profitability of the company after accounting for all expenses and taxes. |

| Calculation | Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue. The formula for gross profit is: Gross Profit = Total Revenue – COGS. | Net profit is derived by deducting all expenses, including operating expenses, taxes, interest, and other expenses, from gross profit. The formula for net profit is: Net Profit = Gross Profit – Operating Expenses – Taxes – Interest – Other Expenses. |

| Represents | Gross profit represents the profitability of a company’s core business activities, excluding operating expenses, taxes, interest, and other non-operating costs. It provides insights into the efficiency of production and pricing strategy. | Net profit reflects the overall profitability of a company after accounting for all expenses and taxes. It indicates the amount of profit available to shareholders after deducting all costs. |

| Importance | Gross profit is important for assessing the efficiency of a company’s production process, pricing strategy, and ability to generate revenue from core business activities. It helps in evaluating the gross margin and gross profit margin of the company. | Net profit is crucial for evaluating the overall financial health and performance of the company. It provides insights into the company’s ability to generate profits after accounting for all expenses and taxes. Net profit is often used by investors, creditors, and stakeholders to assess the company’s profitability and financial sustainability. |

| Example | For example, a manufacturing company’s gross profit is calculated by subtracting the cost of raw materials, labor, and manufacturing overheads from the total revenue generated from sales of goods. | For example, a retail company’s net profit is calculated by deducting all operating expenses, taxes, interest, and other expenses from the gross profit. It reflects the company’s overall profitability after accounting for all costs and taxes. |

Explanation of Points:

- Definition: Gross profit and net profit have distinct definitions. Gross profit focuses solely on the difference between total revenue and the cost of goods sold (COGS), excluding other expenses. Net profit, on the other hand, accounts for all expenses, including operating expenses, taxes, interest, and other costs, after deducting gross profit.

- Calculation: Gross profit is calculated by subtracting COGS from total revenue, whereas net profit is derived by deducting all expenses from gross profit. This calculation process highlights the difference in the scope of expenses considered in each metric.

- Represents: Gross profit represents the profitability of core business activities, excluding operating expenses and taxes. It provides insights into production efficiency and pricing strategy. In contrast, net profit reflects the overall profitability of the company after accounting for all expenses and taxes, offering a comprehensive view of financial performance.

- Importance: Gross profit is essential for evaluating production efficiency and pricing strategy, while net profit is crucial for assessing overall financial health and profitability. Both metrics serve different purposes but are integral to understanding a company’s financial performance.

- Example: The examples provided illustrate how gross profit and net profit are calculated and applied in different business contexts, emphasizing their respective roles in financial analysis and decision-making.

What is Gross Profit?

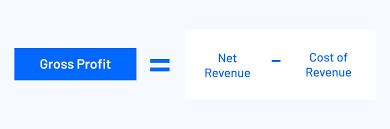

Gross profit is a critical metric that measures the profitability of a company’s core business operations. It is calculated by subtracting the cost of goods sold (COGS) from total revenue. COGS includes the direct costs associated with producing or acquiring the goods or services sold by the company, such as raw materials, labor, and manufacturing overheads.

Gross Profit and Net Profit

Gross Profit and Net Profit

Gross profit provides insights into a company’s production efficiency, pricing strategy, and ability to control production costs. A higher gross profit margin indicates that a company is effectively managing its production costs and generating sufficient revenue to cover its direct expenses.

For example, a retail store that sells clothing purchases inventory from suppliers and sells it to customers. The difference between the selling price of the clothing (revenue) and the cost of purchasing the inventory (COGS) represents the gross profit earned by the store.

Gross profit is a fundamental financial metric that reflects the profitability of a company’s core business activities. It represents the difference between total revenue generated from sales and the cost of goods sold (COGS), excluding operating expenses, taxes, interest, and other non-operating costs. Gross profit is a key indicator of a company’s production efficiency, pricing strategy, and ability to generate revenue from its primary business operations.

Understanding Gross Profit through a Factory Story Example:

Imagine a factory that produces handmade wooden furniture. Let’s explore how gross profit is calculated and understood in the context of this factory’s operations.

The Factory Setup: The factory is equipped with skilled craftsmen, state-of-the-art machinery, and a dedicated production line for manufacturing wooden furniture. It sources high-quality raw materials, including seasoned wood, hardware, and finishing materials, to ensure the production of premium furniture items.

Revenue Generation: The factory sells its furniture products to wholesalers, retailers, and individual customers through various distribution channels, including physical stores and online platforms. Each sale contributes to the factory’s total revenue, reflecting the value of the products sold to customers.

Cost of Goods Sold (COGS):

The cost of goods sold (COGS) for the factory includes all direct costs associated with producing the furniture items. This encompasses the cost of raw materials, labor wages for craftsmen, manufacturing overheads such as electricity and maintenance expenses, and other direct production costs.

Calculation of Gross Profit: To calculate the gross profit of the factory, we subtract the total cost of goods sold (COGS) from the total revenue generated from furniture sales. The formula for gross profit is as follows:

Gross Profit=Total Revenue−Cost of Goods Sold (COGS)Gross Profit=Total Revenue−Cost of Goods Sold (COGS)

Example Calculation:

Suppose the factory generates total revenue of $100,000 from the sale of furniture during a particular period. The total cost of goods sold (COGS), including raw materials, labor, and overhead expenses, amounts to $60,000 during the same period.

Using the formula mentioned above:

Gross Profit=$100,000−$60,000=$40,000Gross Profit=$100,000−$60,000=$40,000

Therefore, the gross profit of the factory for the given period is $40,000.

Interpreting Gross Profit:In the context of the factory’s operations, the gross profit of $40,000 represents the profit earned from producing and selling furniture items, excluding operating expenses and other costs. It reflects the efficiency of the factory’s production process, pricing strategy, and ability to generate revenue from its core business activities.

Significance of Gross Profit:Gross profit serves as a vital financial metric for the factory, providing insights into its production efficiency and profitability. A higher gross profit margin indicates that the factory is effectively managing its production costs, pricing its products competitively, and generating sufficient revenue to cover its direct expenses.

Gross Profit and Net Profit

What is Net Profit?

Net profit, also referred to as the bottom line, is the remaining profit after deducting all expenses from gross profit. These expenses include operating expenses, taxes, interest, and other non-operating costs. Net profit reflects the overall profitability of a company after accounting for all costs and taxes.

Net profit is a key metric for investors, as it indicates the amount of profit available to shareholders after all expenses and taxes have been paid. It is often used to evaluate a company’s financial performance and potential for growth.

Operating expenses deducted from gross profit include salaries, rent, utilities, marketing expenses, and other costs incurred in the day-to-day operations of the business. Taxes and interest expenses represent additional deductions from gross profit, reflecting the financial obligations of the company to external stakeholders and regulatory authorities.

Net profit, often referred to as the bottom line, is a key financial metric that reflects the profitability of a business after deducting all expenses from its total revenue. It provides a comprehensive view of the overall financial performance and success of a company. To illustrate the concept of net profit, let’s delve into a story example of a factory.

Imagine a factory owned by Mr. Smith, who manufactures widgets. Mr. Smith’s factory produces widgets using raw materials, labor, and machinery, which are then sold to customers in the market. Let’s explore how net profit plays out in the operations of Mr. Smith’s factory.

Example Story:

Mr. Smith’s factory operates in a competitive market where demand for widgets fluctuates based on various factors such as consumer preferences, economic conditions, and competitor actions. Despite facing challenges, Mr. Smith is determined to run his factory efficiently and profitably.

At the beginning of the financial year, Mr. Smith sets ambitious goals for his factory, aiming to increase production, expand market reach, and improve profitability. He invests in upgrading machinery, training employees, and enhancing product quality to meet customer expectations and stay ahead of competitors.

Throughout the year, Mr. Smith’s factory operates tirelessly, with workers diligently manufacturing widgets, quality control teams ensuring product standards, and sales teams promoting products to potential customers. As a result of these efforts, the factory generates significant revenue from widget sales in the market.

However, running a factory involves various expenses beyond the cost of raw materials and production. Mr. Smith incurs operating expenses such as salaries for workers, utility bills, maintenance costs for machinery, rent for the factory premises, and administrative expenses for running the business smoothly.

Additionally, the factory is subject to taxes imposed by the government on its income, as well as interest payments on loans or debts incurred for business operations. These expenses, along with other miscellaneous costs, constitute the total expenses incurred by Mr. Smith’s factory during the financial year.

As the end of the financial year approaches, Mr. Smith’s accountant meticulously calculates the financial performance of the factory. Total revenue generated from widget sales is determined, and all expenses incurred by the factory, including operating expenses, taxes, interest, and other costs, are deducted from this revenue.

The result of this calculation is the net profit of Mr. Smith’s factory for the financial year. Net profit represents the amount of money that remains after subtracting all expenses from total revenue. It reflects the true profitability and financial success of the factory during the period.

If the net profit is positive, it indicates that the factory has generated surplus income after covering all expenses, signaling financial health and profitability. Mr. Smith can reinvest this profit back into the business for growth and expansion, distribute dividends to shareholders, or allocate funds for future projects and initiatives.

However, if the net profit is negative, it implies that the factory has incurred losses exceeding its revenue, highlighting financial challenges that need to be addressed. Mr. Smith may need to implement cost-cutting measures, improve operational efficiency, or reassess business strategies to turn the situation around and restore profitability.In either scenario, net profit serves as a critical measure of the factory’s financial performance and guides decision-making to ensure sustainable growth and success in the long run.

Main Differences Between Gross Profit and Net Profit

- Definition: Gross profit represents revenue minus the cost of goods sold (COGS), while net profit is gross profit minus all operating expenses, taxes, interest, and other non-operating costs.

- Calculation: Gross profit is calculated as total revenue minus COGS, whereas net profit is calculated as gross profit minus operating expenses, taxes, interest, and other expenses.

- Significance: Gross profit reflects the profitability of a company’s core business activities, while net profit indicates the overall profitability after accounting for all expenses and taxes.

- Importance: Gross profit helps assess production efficiency and pricing strategy, while net profit is used to evaluate the overall financial health and performance of the company.

Similarities Between Gross Profit and Net Profit

Understanding the similarities between gross profit and net profit is crucial for comprehensively analyzing a company’s financial performance. Despite representing different stages of profitability, these two metrics share several similarities that highlight their importance in assessing business operations. Let’s explore the commonalities between gross profit and net profit:

- Financial Metrics: Both gross profit and net profit are key financial metrics used to evaluate a company’s performance and profitability. They provide insights into different aspects of the business’s revenue and expenses, contributing to a comprehensive understanding of its financial health.

- Derived from Revenue: Gross profit and net profit are derived from the company’s total revenue. Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, while net profit is determined by deducting all expenses, including COGS and operating expenses, from total revenue.

- Reflect Profitability: Both metrics reflect different aspects of a company’s profitability. Gross profit measures the profitability of core business activities by focusing on the difference between revenue and the direct costs associated with producing goods or services. Similarly, net profit provides a broader perspective by considering all expenses, including operating expenses, taxes, interest, and other costs, to determine the overall profitability of the business.

- Indicators of Efficiency: Gross profit and net profit serve as indicators of operational efficiency and effectiveness. A higher gross profit margin indicates that the company is efficiently managing its production costs and pricing strategy, resulting in higher profits from core business activities. Similarly, a positive net profit indicates that the company is effectively managing its expenses and generating profits after accounting for all costs.

- Used for Decision-Making: Both gross profit and net profit are used by stakeholders, including investors, creditors, and management, to make informed decisions about the company. These metrics help assess the company’s financial performance, identify areas of strength and weakness, and formulate strategies for growth and profitability.

- Performance Evaluation: Gross profit and net profit are used for evaluating performance over time and comparing with industry benchmarks or competitors. By analyzing changes in gross profit margin and net profit margin, stakeholders can assess the company’s progress, identify trends, and make adjustments to improve performance.

- Reporting Requirements: Both gross profit and net profit are reported in the company’s financial statements, such as the income statement (profit and loss statement). These statements provide a comprehensive overview of the company’s financial performance, including revenue, expenses, and profitability metrics, to stakeholders and regulatory authorities.

In summary, gross profit and net profit share several similarities as essential financial metrics used to assess a company’s profitability, efficiency, and overall financial performance. While they represent different stages of profitability, understanding their commonalities is essential for conducting comprehensive financial analysis and making informed business decisions.

Conclusion

In conclusion, understanding the difference between gross profit and net profit is crucial for assessing a company’s financial performance and making informed business decisions. While gross profit measures the profitability of core business activities and production efficiency, net profit provides a comprehensive view of overall profitability after accounting for all expenses and taxes. By analyzing both metrics, investors, managers, and stakeholders can gain valuable insights into a company’s operational efficiency, financial health, and growth potential. Therefore, it is essential for businesses to carefully track and analyze both gross profit and net profit to ensure long-term success and sustainability in today’s competitive market environment.