Meaning of Financial Results under Regulation 33

Regulation 33 under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, requires companies listed on the National Stock Exchange (NSE) to disclose their financial result to the stock exchange and make them public.

Financial results refer to the summary of a company’s financial performance for a particular period, usually a quarter or a year. These results provide important information about the company’s revenue, expenses, profitability, assets, liabilities, and cash flow to be displayed on nse.

Under Regulation 33, companies must prepare their financial results as per the guidelines and formats prescribed by SEBI. The financial results must include the income statement, balance sheet, cash flow statement, and notes to accounts.

Companies must also obtain internal approval for the results, and have them audited by a firm of Chartered Accountants registered with the Institute of Chartered Accountants of India (ICAI).

Once the financial results are audited, they must be disclosed to the stock exchange within 45 days from the end of the quarter or half-yearly period, as the case may be. The results can be uploaded on the NSE’s electronic filing platform, NEAPS (NSE Electronic Application Processing System).

The stock exchange officials will scrutinize the financial results for compliance with the regulations and guidelines, and the company may be required to provide additional information or clarification in case of any discrepancies.

Finally, the financial results can be made public and communicated to the shareholders, analysts, and other stakeholders of the company. It’s important to note that financial results should be interpreted in context and not in isolation and should be considered in conjunction with other relevant information about the company’s operations and industry.

Table of Contents

What are Financial Results?

It refers to the summary of a company’s financial performance for a particular period, usually a quarter or a year. These results provide important information about the company’s revenue, expenses, profitability, assets, liabilities, and cash flow.

The income statement is a key component of financial Statements and shows the company’s revenue, expenses, and net income or loss. The balance sheet shows the company’s assets, liabilities, and equity. The cash flow statement shows the cash inflows and outflows during the period and provides insight into the company’s liquidity and cash management.

Financial Statements are important for investors and other stakeholders to evaluate a company’s financial health and performance. They can help investors make informed decisions about buying or selling the company’s stock, and can also help the company’s management identify areas of strength and weakness in its operations.

It’s important to note that financial results should be interpreted in context and not in isolation. Trends and patterns over time should be considered, and comparisons to industry peers and benchmarks can also provide useful insights. It’s always a good idea to consult with a financial advisor or analyst for a more in-depth analysis of a company’s financial result.

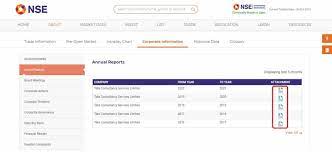

Process to Upload Financial Results on NSE

To upload financial results on the National Stock Exchange (NSE), you need to follow these steps:

- Prepare the financial Statements: Firstly, you need to prepare the financial results for the period under consideration as per the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, which include the income statement, balance sheet, cash flow statement, and notes to accounts.

- Obtain internal approval: Once the financial statements are prepared, they need to be reviewed and approved by the internal audit committee of the company.

- Get the results audited: The financial results need to be audited by a firm of Chartered Accountants who are registered with the Institute of Chartered Accountants of India (ICAI).

- Disclose results to the stock exchange: After the audit is completed, the financial results need to be disclosed to the stock exchange within 45 days from the end of the quarter or half-yearly period, as the case may be. The results can be uploaded on the NSE’s electronic filing platform, NEAPS (NSE Electronic Application Processing System), which is accessible on the NSE website.

- Obtain clearance: Once the financial results are uploaded on NEAPS, they will be scrutinized by the exchange officials. In case of any discrepancies, the company will be required to provide additional information or clarification.

- Make the results public: Once the results are cleared by the stock exchange, they can be made public and communicated to the shareholders, analysts, and other stakeholders of the company.

Timeline for Filing Financial Result on the NSE

Under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, companies listed on the National Stock Exchange (NSE) are required to file their financial statements within a specific timeline. The timeline depends on the period for which the financial results are being filed, i.e., quarterly or half-yearly.

Here is the timeline for filing financial results on the NSE:

- Quarterly financial results:

- The financial results for the quarter ending June 30 must be filed by August 14.

- The financial results for the quarter ending September 30 must be filed by November 14.

- The financial results for the quarter ending December 31 must be filed by February 14.

- The financial results for the quarter ending March 31 must be filed by May 30.

- Half-yearly financial results:

- The financial results for the half-year ending September 30 must be filed by November 14.

- The financial results for the half-year ending March 31 must be filed by May 30.

It’s important for companies to adhere to these timelines to avoid penalties and regulatory action. Companies should ensure that their financial Statements are prepared, audited, and filed within the prescribed timeline to comply with SEBI regulations and keep their shareholders and stakeholders informed about their financial performance.

Who can sign Financial results under Regulation 33?

As per Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the financial results of a company listed on the National Stock Exchange (NSE) must be signed by the following authorized personnel:

- Managing Director (MD) or Chief Executive Officer (CEO) of the company

- Chief Financial Officer (CFO) of the company

- Company Secretary of the company

The above-mentioned personnel are collectively responsible for ensuring that the financial results of the company are prepared and presented in accordance with SEBI regulations and guidelines. They are also responsible for ensuring that the financial results are audited by a firm of Chartered Accountants registered with the Institute of Chartered Accountants of India (ICAI) and that the audit report is attached to the financial results.

It’s important to note that the authorized personnel who sign the financial results must have knowledge and understanding of the company’s financial statements and accounting practices. They must also be aware of their legal and regulatory obligations under the SEBI regulations and guidelines. Any non-compliance or discrepancies in the financial results can attract penalties and regulatory action by SEBI.

How long Financial results under Regulation 33 should be preserved?

As per the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the financial results of a company listed on the National Stock Exchange (NSE) must be preserved for a minimum period of 5 years from the end of the financial year in which they are filed.

This means that the company must maintain a record of its financial results, including the income statement, balance sheet, cash flow statement, and notes to accounts, for a minimum period of 5 years. The records must be maintained in a manner that ensures their accuracy, completeness, and reliability.

In addition to the financial result, the company must also preserve other documents related to its operations, such as board meeting minutes, audit reports, and other financial statements, for a minimum period of 8 years from the end of the financial year in which they are filed.

The preservation of financial records is important for several reasons. It helps the company comply with regulatory requirements and facilitates any future audits or investigations. It also provides a historical record of the company’s financial performance and helps management make informed decisions based on past trends and patterns.

Companies must ensure that their financial records are properly preserved and accessible for the prescribed period, either in physical or electronic form and in compliance with any applicable data protection laws.

What are the effects of Financial Results on the Share Price of the Company?

The financial results of a company can have a significant impact on its share price. The share price of a company is influenced by a variety of factors, including the overall performance of the economy, industry trends, company-specific factors, and market sentiment. However, the financial result of a company is among the most important factors that can influence its share price.

Positive financial Statements, such as an increase in revenue, profits, or earnings per share, can boost investor confidence and result in an increase in demand for the company’s shares. This can cause the share price to rise, reflecting the positive news about the company’s financial performance.

On the other hand, negative financial results, such as a decrease in revenue, profits, or earnings per share, can lead to a decrease in investor confidence and result in a decrease in demand for the company’s shares. This can cause the share price to fall, reflecting the negative news about the company’s financial performance.

It’s important to note that the impact of financial results on a company’s share price can be influenced by a variety of factors, including the expectations of investors, the quality and reliability of the financial results, and the company’s future outlook. Additionally, market sentiment and macroeconomic factors can also impact the share price of a company, even in the presence of positive financial results.

Penalty for Non-Filing of Financial Results under Regulation 33

Under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, failure to file financial Statements by the prescribed deadline can result in penalties and other regulatory action by SEBI.

The penalty for non-filing or delay in filing of Financial Statements under Regulation 33 is as follows:

- Late fees: The company will be required to pay a late fee of Rs. 1,000 per day for each day of delay beyond the prescribed deadline, subject to a maximum of Rs. 5 lakhs or 1% of the net worth of the company, whichever is less.

- Suspension of trading: SEBI may suspend trading in the shares of the company for a specified period if the company fails to file its financial results for two consecutive quarters.

- Prosecution: In extreme cases, SEBI may initiate criminal prosecution against the company and its directors for non-compliance with the regulations.

The penalties and regulatory action are intended to ensure compliance with the SEBI regulations and guidelines and to protect the interests of the investors and other stakeholders. Therefore, it is essential for companies to adhere to the prescribed timeline and file their financial Statements on time to avoid any penalties or regulatory action by SEBI.